Limited access

If you won’t need to dip into your savings very often and you’re looking to receive higher rates of interest, a limited access savings account could be the right savings account for you.

If you won’t need to dip into your savings very often and you’re looking to receive higher rates of interest, a limited access savings account could be the right savings account for you.

Do you want to grow your savings and earn increased levels of interest? If so, you may well find that a limited access savers account is the ideal choice. Beehive limited access savers exchange restrictions on withdrawals for higher interest rates, making it a great choice for long term savings goals.

You can open a Beehive limited savings account with £1,000 and pay money in anytime.

There are limits on when you can withdraw money from your limited access savings accounts, so it's important that you're sure you won't need access to it. However, limiting the amount of withdrawals will provide you with higher interest payments than more easily accessible accounts.

A limited access saver offers plenty of incentive to keep your savings in your account for longer thanks to the higher available interest rates.

See our regular savers

Maximum of two withdrawals per interest year to qualify for conditional bonus

Maximum of two withdrawals per interest year to qualify for conditional bonus

Interest year runs from 1st September - 31st August

Interest year runs from 1st September - 31st August

Interest is paid annually on 31st August

Interest is paid annually on 31st August

Open online or in the app

Open online or in the app

UK residents aged 18 or over

UK residents aged 18 or over

Instant access to your savings

Instant access to your savings

Manage your account 24/7

Manage your account 24/7

A limited access saver is a great option for long term savings goals thanks to higher interest rates.

Pay in whatever and whenever you like, without having to commit to fixed payments.

Download the app, set your goals, follow milestones and be more likely to achieve them with Beehive's handy savings tools.

You can open a savings account online or through the Beehive Money app. All of our accounts are just for UK residents; we pay interest annually; and how often (and how much) you can withdraw depends on the account. Bear in mind too that any of our products can be withdrawn at any time.

You should regularly review any savings you have. See our full range of savings accounts below, compare interest rates and find the right product for your goals.

Need help deciding? Choose how much you’re likely to deposit to see the estimated total interest you could earn in 12 months. We’ve calculated it using the AER (Annual Equivalent Rate), assuming you’ll put in the amount you’ve chosen on the day that account launches. This gives you an idea of how much interest you might earn, based on your deposit.

For ISAs

*We will pay your interest free of UK income tax. Your tax treatment will depend on your individual circumstances and may be subject to change in the future. The tax treatment of ISAs may also change. AER stands for Annual Equivalent Rate. It shows what the interest rate would be if the interest was reinvested in the account each year. Interest rates are variable unless otherwise stated.

For non ISAs

*We will pay your interest without tax taken off. It is your responsibility to declare any interest you earn over your personal savings allowance directly to HMRC. Your tax treatment will depend on your individual circumstances and may be subject to change in the future, for further information please contact HMRC. AER stands for Annual Equivalent Rate. It shows what the interest rate would be if the interest was re-invested in the account each year. Interest rates are variable unless otherwise stated.

Things to know

Your gross rate is the amount of interest you’ll earn each year before tax. AER, or Annual Equivalent Rate, is designed to make savings accounts easier to compare. The AER will show you what your interest rate would be if interest was paid back into your account. For accounts that pay interest annually, the gross rate and the AER should be the same. For accounts that pay interest monthly the AER will be slightly higher than the gross rate. This is because if you leave your monthly interest in the account you’d start to earn interest on the interest.

These are just estimates and they’re for illustrative purposes only. Deposit examples may not reflect actual product deposit limits. We’ve based our calculations on the assumptions that the account is opened the day it’s made available; the interest rate doesn’t change; interest is paid straight into your account; and that you don’t put in any more money or take it out. So, if any of these things change, so will the amount of money you earn on your deposit.

To join Beehive Money you can do this one of two ways. You can register on your desktop, or if you'd prefer you can install our app and follow the instructions on your screen.

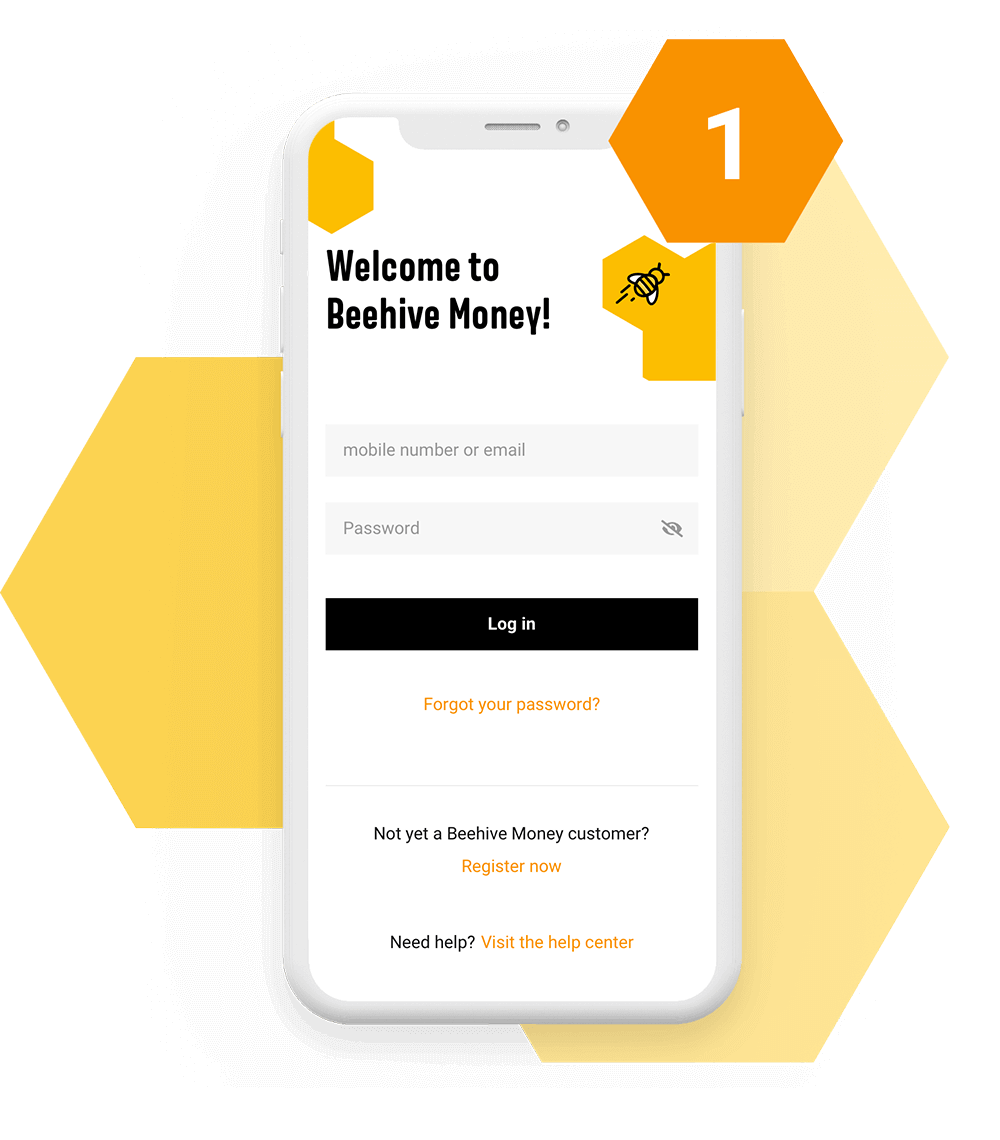

Once you have access to Beehive, choose the account that's right for you. We have a whole range available, such as fixed rates, easy access accounts, Cash ISAs and the Lifetime ISA.

We know that you’re more likely to achieve your dream if you set goals. Our goal tracker and a helpful milestone will help motivate you to save for a brighter future.

Your savings will be protected up to a total of £85,000 by the Financial Services Compensation Scheme. There’s more about that here.

Don’t sweat it, we have a range of accounts you can choose from. Check them out below.

Our easy access account is a flexible account with very few restrictions, which makes it a great choice for those who want to put away money but be able to access it at any time, without charges or penalties, and it’s never, ever 'locked' away.

Easy access accounts

Moving into your first home is easier with the Homebuyer Lifetime ISA thanks to a generous 25% Government bonus. Plus, get mortgage advice from our partner when you're ready to move in.

Lifetime ISA

Not sure about which account you’re after? Whatever your goals and however you’d like to save, we have a range of accounts for almost everyone at Beehive.

See all our accounts