Online Easy Access ISA

- - Tax-free p.a./AER*

- - Open online with £10

- - Deposit up to £20,000 a year

- - For ages 18+

- - Easy access to your savings

- - Unlimited penalty-free withdrawals

- - No transfers of ISA savings

If you're looking for a place to put away your savings – totally tax free – with anytime access, then our easy access ISA could be a great choice. There’s no charge on withdrawals and as for payments, you can make these as often as you like.

An easy access ISA is like an easy access savings account, but it just comes in an ISA wrapper which means it’s tax-free.

With this account, you'll be able to dip into your savings anytime you need, and can pay in as much, or as little as you like, without any charges or penalties (providing it’s within the annual ISA allowance and isn't more than £250,000).

You've even got a choice between how often you pay in – so whether it's a lump sum now and then or a regular monthly payment, it's entirely up to you. Even better, you’ll also earn interest (tax-free, as mentioned above) on your savings. Easy access ISAs are open to UK residents over 18, and depending on the account, can be set up with just a £10 deposit. You can see all of our easy access ISA rates below too where we take you through the different accounts that we have on offer at the moment.

If you’re looking for high interest easy access ISAs, then you might not find exactly what you’re looking for as the nature of easy access accounts means that the interest rates are usually lower than accounts where you’re not able to access your money. High interest rate ISAs are available on the market, but you will usually have to lock your savings away for a longer time - from a year to up to five years or more.

UK residents aged 18 or over

UK residents aged 18 or over

Open online with £10 today

Open online with £10 today

Save up to £20,000 for current tax year

Save up to £20,000 for current tax year

Earn interest tax-free

Earn interest tax-free

Unlimited penalty-free withdrawals

Unlimited penalty-free withdrawals

Easy access to your savings

Easy access to your savings

Manage your account on the go

Manage your account on the go

No transfers of ISA savings

No transfers of ISA savings

Wondering what an instant access ISA is if you’ve heard the term used interchangeably with ‘easy access’? It’s very similar but instant access is only available on the high-street in a branch environment because you’d be ‘instantly’ receiving your withdrawal over the counter. Easy access is used to describe the almost-instant withdrawal you’ll get with an online account of the same nature as it may take a few hours or even a working day for the money to land in your nominated bank account.

You can open a savings account through the Beehive Money app or online via desktop. All our accounts are just for UK residents; we pay interest annually; and how often (and how much) you can withdraw depends on the account. Bear in mind too that any of our products can be withdrawn at any time.

Pay in whatever and whenever you like, without having to commit to fixed payments, (remember it has to be within the annual allowance and not over £250,000).

Access your money anytime you need it. Enjoy unlimited withdrawals, without penalties or charges. But, remember it all counts towards your £20,000 ISA allowance.

Like other ISAs, the easy access ISA is a tax-free savings account. That means you won’t have to pay tax on the interest you earn.

You can open a savings account through the Beehive Money app. All of our ISAs are just for UK residents; we pay interest annually; and how often (and how much) you can withdraw depends on the account. Bear in mind too that any of our products can be withdrawn at any time.

You should regularly review any savings you have. See our range of accounts below, compare interest rates and find the right product for your goals.

Need help deciding? Choose how much you’re likely to deposit to see the estimated total interest you could earn in 12 months. We’ve calculated it using the AER (Annual Equivalent Rate), assuming you’ll put in the amount you’ve chosen on the day that account launches. This gives you an idea of how much interest you might earn, based on your deposit.

For ISAs

*We will pay your interest free of UK income tax. Your tax treatment will depend on your individual circumstances and may be subject to change in the future. The tax treatment of ISAs may also change. AER stands for Annual Equivalent Rate. It shows what the interest rate would be if the interest was reinvested in the account each year. Interest rates are variable unless otherwise stated.

Things to know

Your gross rate is the amount of interest you’ll earn each year before tax. AER, or Annual Equivalent Rate, is designed to make savings accounts easier to compare. The AER will show you what your interest rate would be if interest was paid back into your account. For accounts that pay interest annually, the gross rate and the AER should be the same. For accounts that pay interest monthly the AER will be slightly higher than the gross rate. This is because if you leave your monthly interest in the account you’d start to earn interest on the interest.

These are just estimates and they’re for illustrative purposes only. Deposit examples may not reflect actual product deposit limits. We’ve based our calculations on the assumptions that the account is opened the day it’s made available; the interest rate doesn’t change; interest is paid straight into your account; and that you don’t put in any more money or take it out. So, if any of these things change, so will the amount of money you earn on your deposit.

Tax-free savings accounts (also known as Individual Savings Accounts or ISAs), are simple, really: with accounts like these you won’t have to pay tax on the interest you earn. There’s also a cap on how much you can add each tax year, depending on your circumstances, and keep in mind that the tax rules around ISAs could change

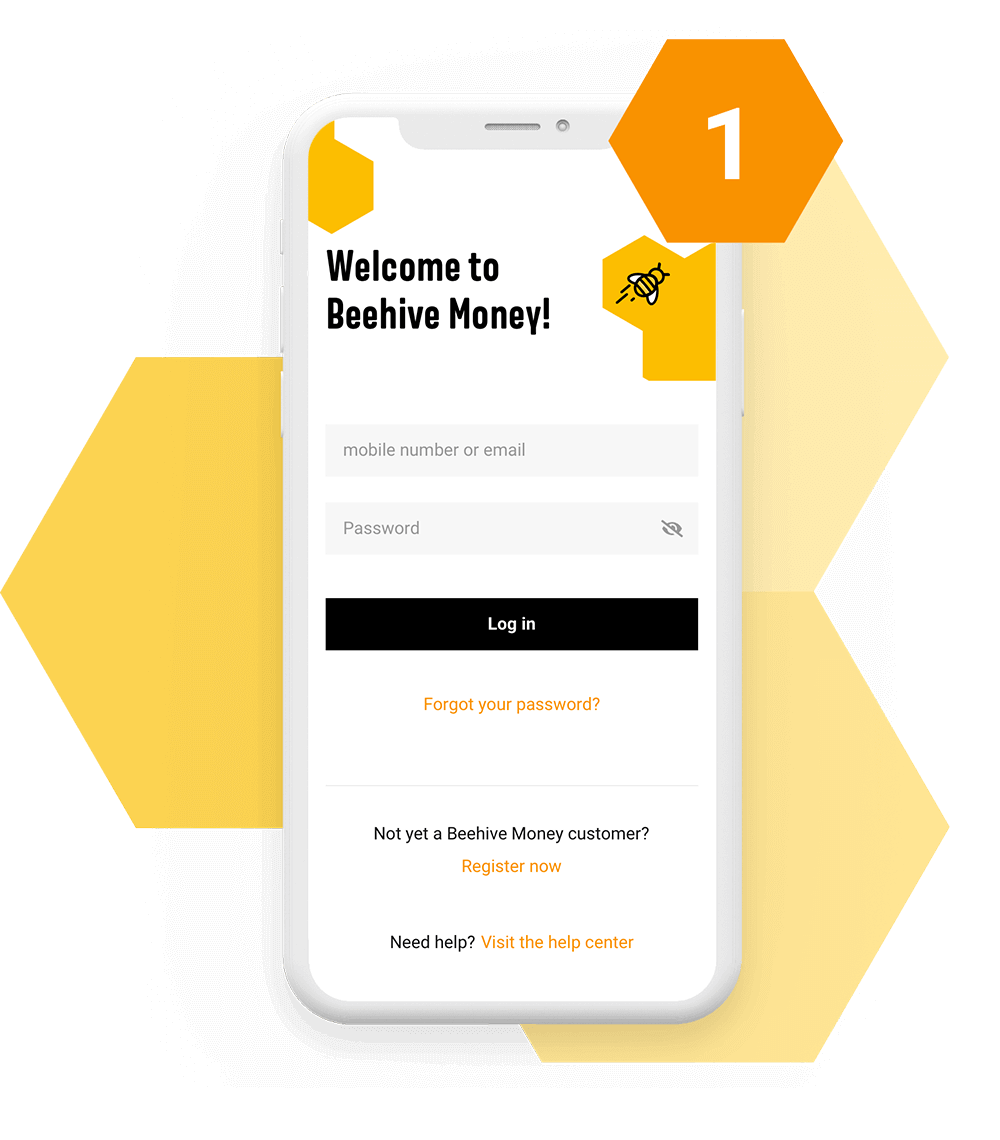

To join Beehive Money you can do this one of two ways. You can register on your desktop, or if you'd prefer you can install our app and follow the instructions on your screen.

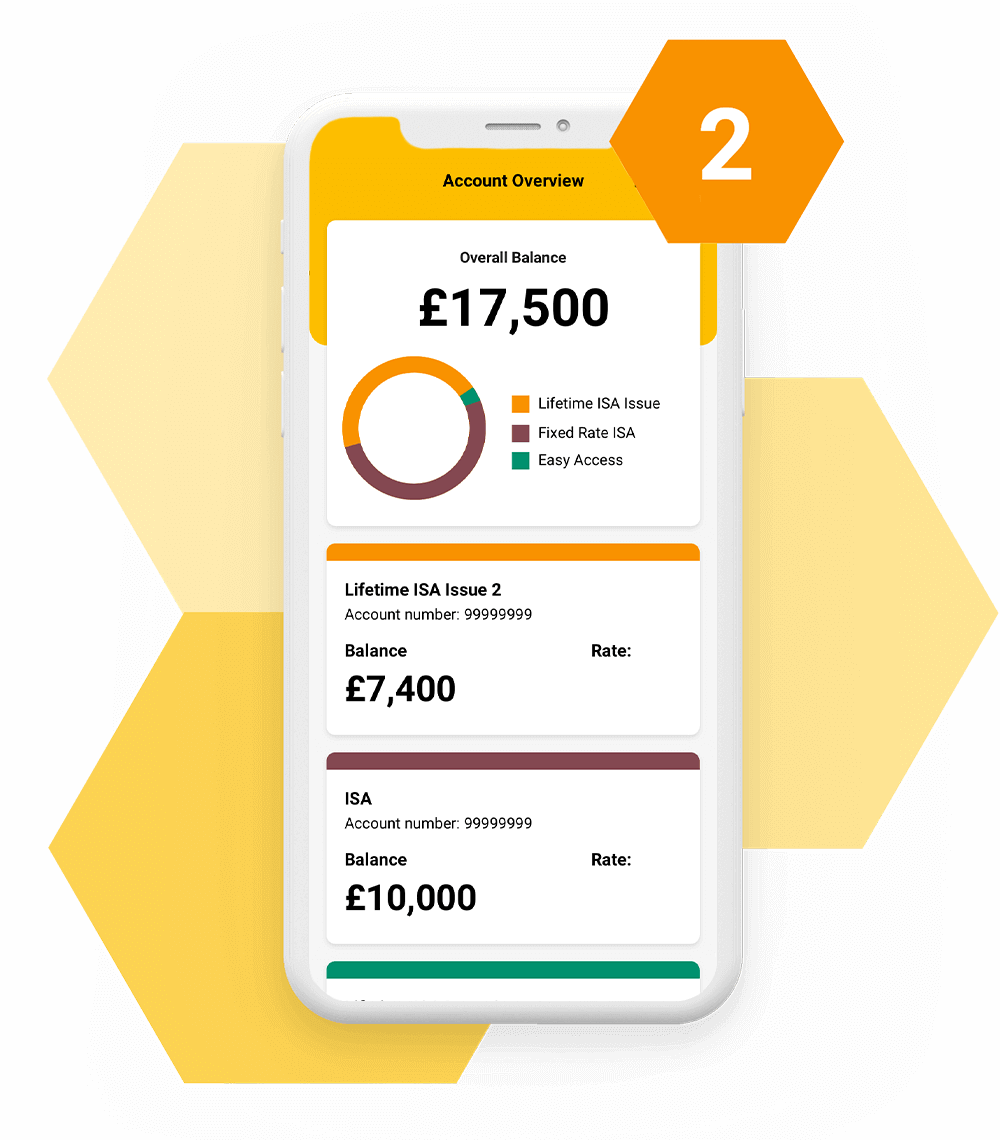

Once you have access to Beehive, choose the account that's right for you. We have a whole range available, such as fixed rates, easy access accounts, Cash ISAs and the Lifetime ISA.

We know that you’re more likely to achieve your dream if you set goals. Our goal tracker and a helpful milestone will help motivate you to save for a brighter future.

The ISA allowance for this year is £20,000, but this is divided across all the ISAs you want to pay into. Bear in mind that paying in, and later withdrawing, still counts towards your allowance. But, it all resets on 6th April – ready for the new financial year.

Whenever – and however much – you like, with absolutely no penalties to pay.

Yes, your money is protected up to £85,000 under the FSCS scheme. You can learn more here.

For all of our easy access ISAs, interest is paid on 5th April each year, as a lump sum.

If you’re deciding between an easy access ISA and an easy access account, then it’s good to weigh up the pros and cons of each. While the ISA is tax-free, it’s also restricted by the yearly ISA allowance, or limit, on the amount of money you can deposit. Overall, you can only deposit £20,000 across all of your ISAs each tax year. There are no restrictions on how much you can deposit in the easy access ISA account providing it doesn't exceed the £250,000 limit. Depending on how much of your Personal Savings Allowance you’ve used — it might be taxable.

Your savings will be protected up to a total of £85,000 by the Financial Services Compensation Scheme. There’s more about that here.

Don’t sweat it, we have a range of accounts you can choose from. Check them out below.

Our easy access account is a flexible account with very few restrictions, which makes it a great choice for those who want to put away money but be able to access it at any time, without charges or penalties, and it’s never, ever 'locked' away.

Easy access accounts

If you can put your money away for a set period in a fixed rate savings account, we'll pay you a fixed rate of interest. You can be rest assured that the interest rate will stay the same for the term of your account.

Fixed rate accounts

Not sure about which account you’re after? Whatever your goals and however you’d like to save, we have a range of accounts for almost everyone at Beehive.

See all our accounts